Source: Statista, Mar 2023

Source: CBS News, Feb 2023

More than one-third of the wealthiest people in the U.S. attended one of just eight elite universities, according to a new study from wealth consultancy Henley & Partners.

There are about 9,600 so-called centimillionaires living in the U.S., or people whose net worth is greater than $100 million, the report noted. About 35% of them attended one of eight U.S. universities: Harvard, MIT, Stanford, the University of Pennsylvania, Columbia, Yale, Cornell and Princeton, the analysis found.

The findings track the most recent degree earned by centimillionaires, which means that the report includes graduate school degrees such as MBAs, noted Andrew Amoils, head of research at New World Wealth, who worked on the report.

Posted in Success

Related Resource: The Quote Investigator, May 2010

Not everything that can be counted counts.

Not everything that counts can be counted.

The position of the two key terms “counted” and “counts” is reversed in the two different phrases. This rhetorical technique is referred to as chiasmus or antimetabole. QI hypothesizes that the two phrases were crafted separately and then at a later time combined by Cameron to yield the witty and memorable maxim.

Source: WSJ, Nov 2020

Over the past decade, Mr. Ma, 56 years old, has come to epitomize the success of China’s internet and technology stalwarts. A former English teacher who loves martial-arts novels and Tai-chi, he founded e-commerce company Alibaba in his apartment in 1999, and its 2014 listing in New York held the record for the world’s largest IPO until last year.

Before his retirement from Alibaba last year, Mr. Ma often sang and performed at annual company galas. He celebrated his last day at the company by performing in a rock band wearing braided hair extensions and a leather jacket with spikes, in a Hangzhou stadium packed with 40,000 Alibaba and Ant employees.

Alibaba this year solidified its position as China’s most valuable listed company after more than quadrupling its market capitalization in barely six years. Ant’s listing, had it gone ahead, would have valued the company at more than $300 billion and made it worth more than most of China’s and America’s largest banks.

In 2008, when he was Alibaba’s CEO, Mr. Ma had lamented at a public forum that traditional banks in China were ignoring businesses that badly needed funding. “If the banks don’t change, we will change the banks,” he said, explaining that he envisioned “a more comprehensive lending system that served the needs of small businesses.”

In 2013, as Alibaba’s chairman, he again took aim at traditional Chinese lenders, saying at a public forum in Shanghai that the country didn’t lack banks or innovative institutions, but a financial institution that could power China’s economic growth in the next decade. “The financial industry needs disrupters” and outsiders to bring about changes, he said.

Around that time, Alipay created an online money-market mutual fund designed to help individuals earn investment returns on spare electronic cash sitting in their Alipay wallets. It was an instant success. Some people moved money out of their bank accounts into the new fund to earn higher returns, drawing complaints from some lenders that Alipay was siphoning their deposits.

In 2014, Alipay, along with Alibaba’s other financial businesses, were folded into Ant Financial Services Group, the company now known as Ant Group.

On Oct. 24, Mr. Ma took the stage at a financial forum in Shanghai attended by top regulators, politicians and bankers. He said Ant’s IPO was “a miracle,” being such a large deal taking place away from New York. Attendees included China’s Vice President Wang Qishan, central bank governor Yi Gang and some senior state-bank executives.

During his 21-minute speech, he criticized Beijing’s campaign to control financial risks. “There is no systemic risk in China’s financial system,” he said. “Chinese finance has no system.”

He also took aim at the regulators, saying they “have only focused on risks and overlooked development.” He accused big Chinese banks of harboring a “pawnshop mentality.” That, Mr. Ma said, has “hurt a lot of entrepreneurs.”

His remarks went viral on Chinese social media, where some users applauded Mr. Ma for daring to speak out. In Beijing, though, senior officials were angry, and officials long calling for tighter financial regulation spoke up.

Ant’s shareholders include Boyu Capital, a private-equity fund whose partners include Alvin Jiang, the grandson of former Chinese leader Jiang Zemin. China’s national pension fund, China Development Bank and China International Capital Corp. , the country’s top investment bank, all have large unrealized profits on their investments in Ant.

Mr. Xi sought to tighten financial regulations overall after the 2015 stock-market crash in China that tested the party’s firm hold on the economy. He also came to appreciate the benefits of having firms like Mr. Ma’s, whose payment app and lending operations changed the way the Chinese spend money, provided a reliable source of funding for small businesses, and made Alibaba Group Holding Ltd. BABA -0.50% , the e-commerce giant which Mr. Ma co-founded and used to run, the pride of China.

The decision was aimed squarely at Ant, the government officials said, and cleared the way for the pro-stability members of the group to dust off draft regulations they had been working on for a long time.

Among them was one regulating online microlending. With Mr. Xi’s blessing, the central bank and the banking regulator made the draft rule even tougher than previously conceived, according to the Chinese officials familiar with the decision-making. The new rule had a requirement that didn’t exist in previous drafts: Firms such as Ant would need to fund at least 30% of each loan it makes in conjunction with banks.

Ant could try again to go public. Market participants believe it will reorganize its business units, rethink its business model and inform investors of additional risks. All this likely will mean that Ant’s lofty valuation will be cut when it tries to list again, and the company may not be able to raise as much money as it aimed for this round, analysts say.

Posted in Entrepreneurship, Success

Source: HBR, Aug 2019

You’ve checked all the boxes. You’ve graduated from the right college, held the right internship, flourished in the right graduate program, and landed the right job at the right company. You’ve followed the path that everyone else told you would be the one to lead to success — to your dream job — only to find that your dream job doesn’t feel so dreamy after all.

a 2015 study by Gallup showed that only one-third of the American workforce feels actively engaged in their work.

One-third of Americans over the age of fifty —nearly 34 million people — stated that they were seeking to fill their time with some professional (paid or unpaid) purpose beyond just the self.

If you’ve determined that your dream job is not really all that dreamy, it may be that you have done all the right things along everyone else’s path to everyone else’s definition of success, only to realize when you’ve moved into a new age or life stage that the great life you built was meant for someone else.

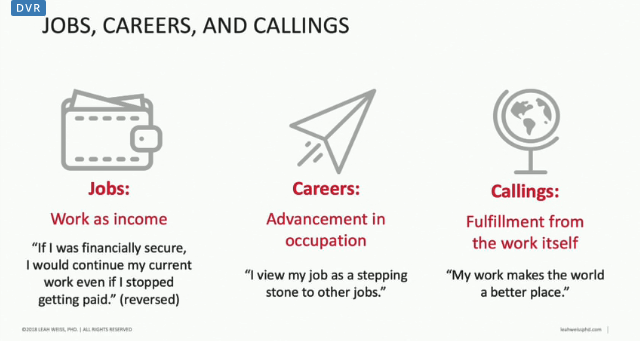

Consonance is when what you do matches who you are (or who you want to be). You achieve consonance when your work has purpose and meaning for you.

The elements of consonance are calling, connection, contribution, and control:

Calling is a gravitational pull towards a goal larger than yourself — a business you want to build, a leader who inspires you, a societal ill you wish to remedy, a cause you wish to serve.

Connection gives you sightlines into how your everyday work serves that calling by solving the problem at hand, growing the company’s bottom line, or reaching that goal.

Contribution means that you understand how this job, this brand, this paycheck contributes to the community to which you want to belong, the person you want to be, or the lifestyle you’d like to live.

Control reflects how you are able to influence your connection to that calling in order to have some say in the assignment of projects, deadlines, colleagues, and clients; to offer input into shared goals; and to do work that contributes to your career trajectory and earnings.

Source: Marketwatch, May 2019

Research published online Monday in the Journal of Personality and Social Psychology found that people in higher social classes tend to think they are more adept at certain tasks — even when they are not — than their lower-class peers. And that overconfidence is often seen by others as competence, which can help them in situations like job interviews, the research reveals.

when participants in this study were then asked to do a mock job interview that was videotaped, those in the higher social classes seemed more confident, and the judges watching the video then rated those same people as more competent.

“Individuals with relatively high social class were more overconfident, which in turn was associated with being perceived as more competent and ultimately more hirable, even though, on average, they were no better at the trivia test than their lower-class counterparts,” said lead researcher Peter Belmi, of the University of Virginia.

… There are many ways to feel confident — <and> can make us feel good about ourselves.

To appear confident,

Source: Farnam Street, Jan 2019

the way you live your life—the extent to which you intelligent prepare—makes a huge difference.

If what you are working on is not important and aligned with your goals—and a lot of what you do and say isn’t—then why are you doing it? The question you need to ask yourself if “why are you not working on and thinking about the important problems in your area?” How can we expect to achieve great things if we are not working on the right problems?

2. You need to be willing to look like an idiot. Think of this as confidence meets courage.

3. You need to strive for excellence.

4. The conditions you think you want are rarely the ones that help you produce your best work. You need the feedback of reality in order to keep your feet planted on the ground.

5. Work with your door open.

6. People who do great things typically have a great drive to do things.

7. People who do great things tolerate ambiguity — they can both believe and not believe at the same time.

Posted in Success

Source: The Hedgehog Review, Summer 2016

as historian Joseph F. Kett has shown, in a fascinating and subtle study of merit’s travails through three centuries of American history, there are at least two strikingly different ways in which merit has been understood in that history.4 The founding generation itself thought in terms of what Kett calls “essential merit,” by which he means merit that rests on specific and visible achievements by an individual that were thought, in turn, to reflect that individual’s estimable character, quite apart from his social “rank.” “Merit” was that quality in the person that propelled the achievements, his “essential character.” Those who did the achieving were known as “men of merit,”

over time, a different way of understanding merit began to emerge, an ideal Kett calls “institutional merit.” Rather than focusing on questions of character, this new form of merit concerned itself with the acquisition of specialized knowledge, the kind that is susceptible of being taught in schools, tested in written examinations, and certified by expert-staffed credentialing bodies.

We would do well to leave room for the Lincolns among us—especially if they are as raw and uncredentialed as the man who would become our sixteenth president was. Think of his great speech at the dedication of the cemetery in Gettysburg in November 1863.

As many know, there were two notable speeches that day. The first, and the longest and most learned and most florid, was given by the supremely well-pedigreed Edward Everett, former president of Harvard—and the first American to receive a German PhD. But it was the self-educated frontiersman president who gave the speech whose accents ring down through the ages. Perhaps there is a pattern here to learn from.

Posted in History, Leadership, Learning, Life, Success

Source: SingHealth, Feb 2016

Two things are essential for success in research: the freedom to do blue-skies research, and embracing both luck and failure, said Sir Richard Roberts, who was awarded the 1993 Nobel Prize in Physiology or Medicine with Phillip Allen Sharp for the discovery of introns in eukaryotic DNA and the mechanism of gene-splicing.